Accounting for Convertible Bond

What is a Convertible Bond. Ad Get Exclusive Access to Top-Tier Freelance Accounting Finance Professionals with Paro.

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

An Introduction To Convertible Bonds

The recorded amount of interest expense is based on the interest rate stated on the face of the bond.

. ABC LTD issues 1 million convertible bonds of 1 each carrying nominal interest of 10. Ad Get Complete Accounting Products From QuickBooks. The bonds get secured with the companys physical assets and the bonds get converted only at the discretion of the.

This lesson provides a detailed definition as well as examples. Paro Engineers Your Growth for the Long Run. Galaxy Corporation had outstanding 3000 1000 bonds each convertible into 40 shares of 10 par value common stock.

Ad Browse Discover Thousands of Book Titles for Less. In this video well use the present value method to calculate the liability and equity components and to explore the double entry. Accounting for Convertible Bond.

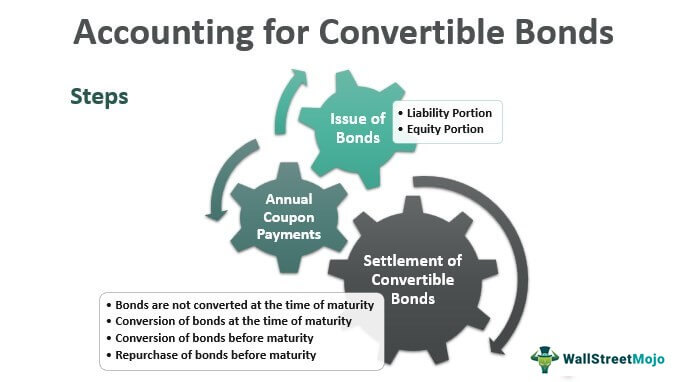

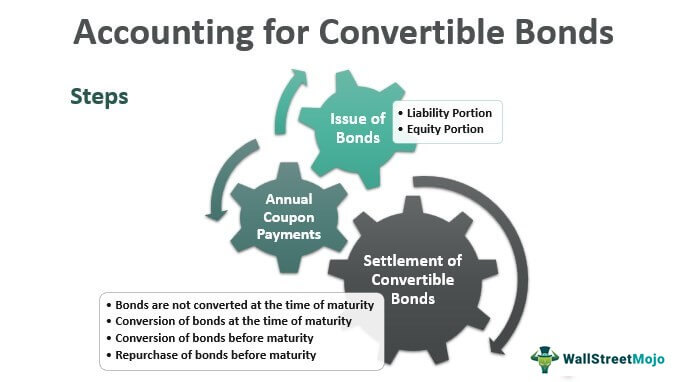

Find A Dedicated Financial Advisor. A convertible debt instrument is a compound financial instrument sometimes called a hybrid ie. Accounting for Convertible Bonds Debt.

Get QuickBooks - Top-Rated Online Accounting Software For Businesses. Convertible bonds are a special type of bond that gives the owner the option to trade for a certain amount of stock in the company. The accounting for convertible securities involves recognizing the conversion of debt securities into equity.

It has characteristics of both debt and equity funding for a company. Its valuation is derived from both the level of interest rates and the price of the underlying equity. The conversion option is usually available only.

Any further impact on interest rates. Convertible bonds which have features of both are especially confusing. A convertible security is a debt instrument that gives the holder the.

From the above accounting for issuance of convertible bonds it is possible to derive the journal entries. Accounting for Bond Interest Payments. Expert Talent Without the Full-Time Price.

Do Your Investments Align with Your Goals. Lets Partner Through All Of It. As mentioned this process involves impacting both equity and liability.

In August the FASB issued a new standard ASU 2020-06 to reduce the complexity of accounting for convertible debt and other equity-linked instruments. A convertible bond is a bond that can be converted to stock using a predetermined conversion ratio. Ad Life Is For Living.

For example embedded derivatives may need to be. Get QuickBooks - Top-Rated Online Accounting Software For Businesses. Find a Dedicated Financial Advisor Now.

Accounting for Convertible Bonds Illustration Example. A frequent concern for companies is how to classify debt and equity. The complexity in accounting for convertible securities can have unexpected financial reporting impacts that need to be fully evaluated.

Accounting for Convertibles refers to the accounting of the debt instrument that entitles or provide rights to the holder to convert its holding into a specified number of issuing. Changes to convertible bond accounting under US GAAP will mean higher reported debt but paradoxically a lower and sometimes zero interest expense. The bonds were converted on.

A convertible bond is a hybrid security part debt and part equity. Ad Get Complete Accounting Products From QuickBooks. In this article well discuss the basics of recording an issuance of convertible bonds and transferring the bond liability to equity accounts when the bonds are converted.

By Josh Schaeffer PhD and Nikhil Guruji. 2 minutes of reading.

Accounting For Convertible Bonds With Incentives Residual Method Ifrs Aspe Youtube

Convertible Bonds Using Market Value Method Accounting Complete Calculations J E S Youtube

Convertible Bonds Using Book Value Method Accounting Complete Calculations J E S Youtube

Accounting For Convertible Bonds Debt With Examples

0 Response to "Accounting for Convertible Bond"

Post a Comment